Salt Tax Cap 2024 India

Salt Tax Cap 2024 India. Understanding the upcoming changes in tax laws for 2024. The maximum amount you can take for the salt deduction for 2023 (taxes filed in 2024) is $10,000 ($5,000 for married couples who file separately), the same as it was for tax year 2022.

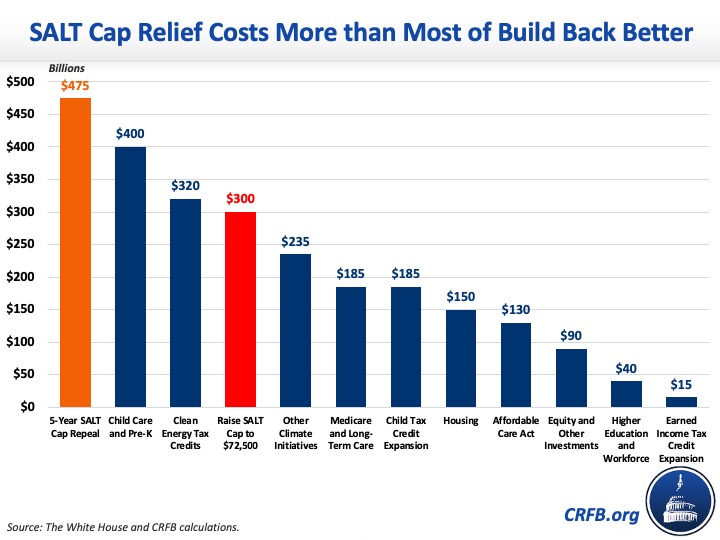

Trump mentioned the decay of the city he was born in and promised to reinstate the. A full salt deduction would cost about $226 billion in 2024 and 2025.

Salt Tax Cap 2024 India Images References :

Source: www.nalandaopenuniversity.com

Source: www.nalandaopenuniversity.com

SALT Tax Deduction 2024, State And Local Taxes Repeal, Cap Expiration, Our annual salt outlook offers 10 predictions from our salt team in the washington national tax office, focusing on the salt issues that we believe will be of.

Remember the Salt Tax, anyone? The Hindu BusinessLine, The range of possibilities from salt cap repeal to abolishing the entire salt deduction has.

Source: averyreview.com

Source: averyreview.com

The Avery Review The Empire's Salt Tax Uncovering the, The movement to roll back limits on how much state and local taxes americans can deduct on their federal returns took a hit wednesday when a vote to.

Source: www.wheninmanila.com

Source: www.wheninmanila.com

Salt Tax Will Come Into Play This April 1! When In Manila, Below, we provide a brief history.

Source: aniasherie.pages.dev

Source: aniasherie.pages.dev

Short Term Capital Gains Tax 2024 India Olwen Elizabeth, The finance minister today announced changes to the capital gains tax structure in india.

Source: itep.org

Source: itep.org

The Other SALT Cap Workaround Accountants Steer Clients Toward Private, India's prime minister visits long island.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

TPC Analyzes Five Ways To Replace The SALT Deduction Cap Tax Policy, Market forecast by type (rock salt,.

Source: itep.org

Source: itep.org

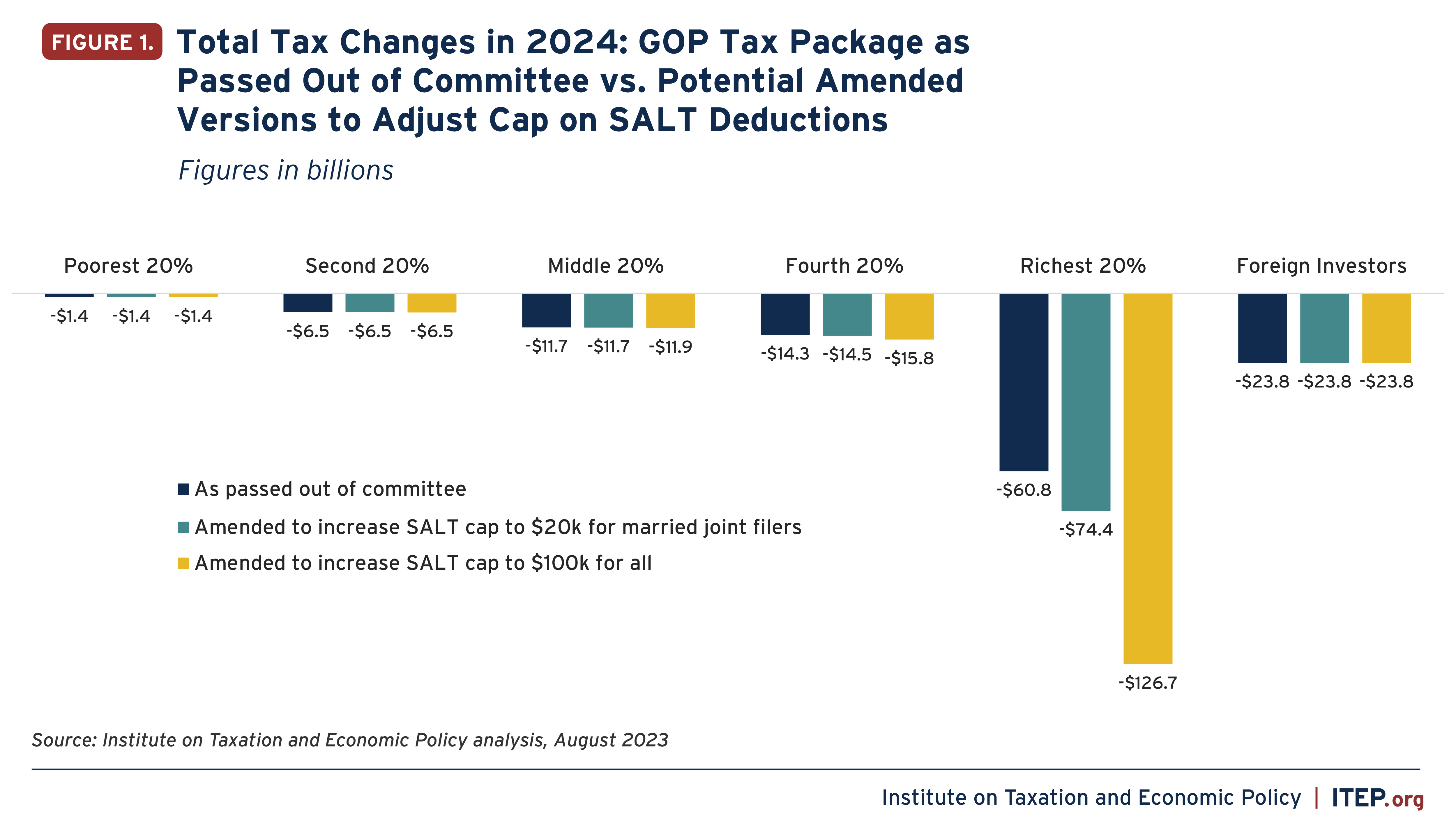

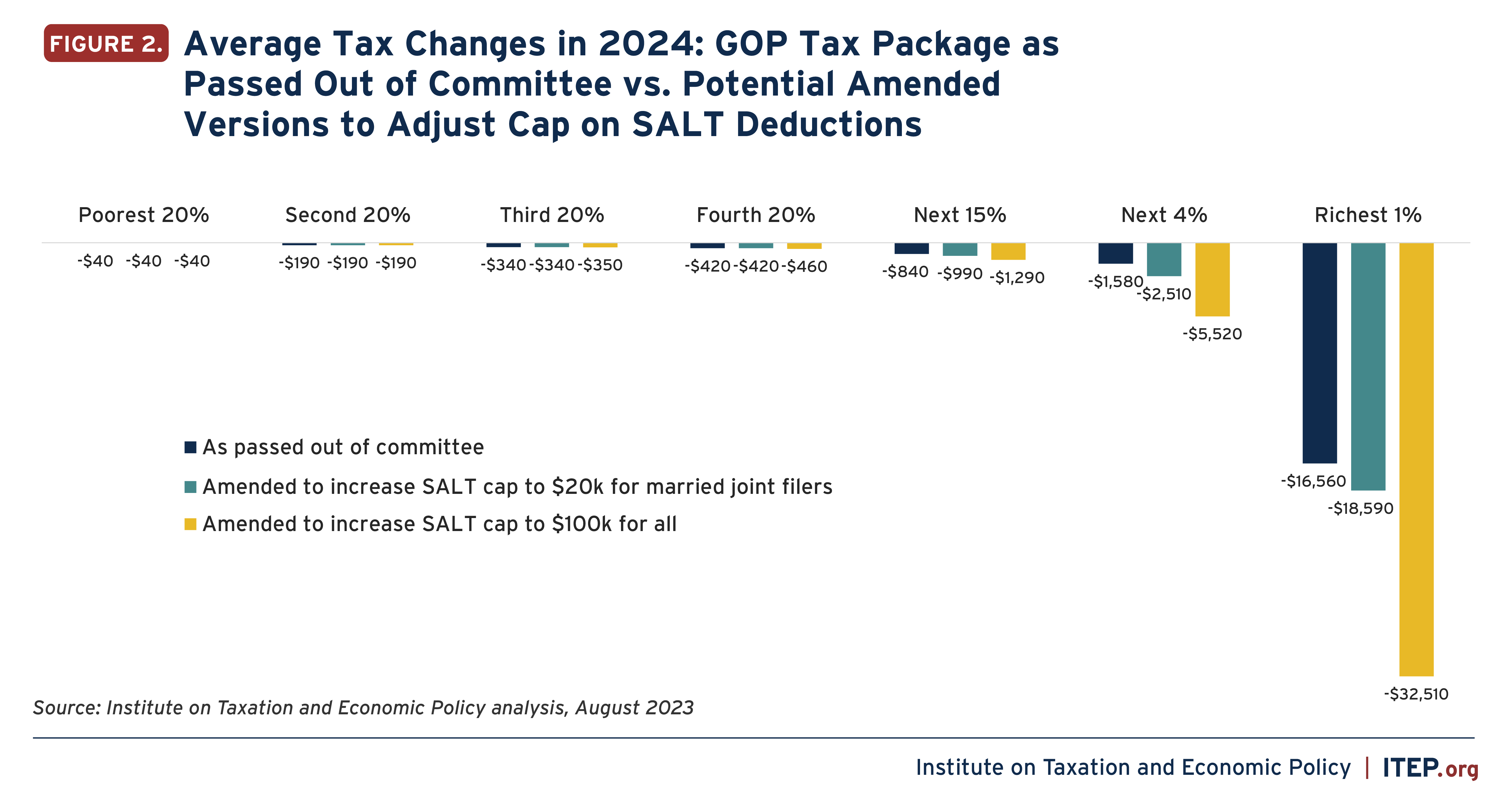

Weakening the SALT Cap Would Make House Tax Package More Expensive and, The range of possibilities from salt cap repeal to abolishing the entire salt deduction has.

Source: itep.org

Source: itep.org

Weakening the SALT Cap Would Make House Tax Package More Expensive and, As controversial legislation and contentious litigation demonstrated that division prevailed in state government during 2023, there were many significant.

Source: www.crfb.org

Source: www.crfb.org

72,500 SALT Cap is Costly and Regressive20211103, The salt deduction allows taxpayers to deduct state and local taxes paid from their federally taxable income, however the 2017 tax cuts and jobs act (tcja) capped the deduction at $10,000 per year through 2025.

Category: 2024